lincoln ne sales tax calculator

Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. Cloud-Based Sales Use Tax Solution.

Utah Sales Tax On Cars Everything You Need To Know

There are no changes to local sales and use tax rates that are effective July 1 2022.

. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Lincoln NE. Real property tax on median home. Ad Lookup Sales Tax Rates For Free.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. Long- and short-term capital gains are included as regular income on your Nebraska income tax return. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

That means they are taxed at the rates listed above 246 - 684 depending on your total taxable income. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. The Sales tax rates may differ depending on the type of purchase.

Sales Tax Amount 754remit to Nebraska Department of Revenue Lodging Tax Calculation Gross Receipts 10400 Lodging Tax 5 State 1 and County 4 x 05remit to Nebraska Department of Revenue Lodge Tax Amount 520 The customers bill should show. Nebraskas sales and use taxes are five percent. Property tax rates in the county are well above the state.

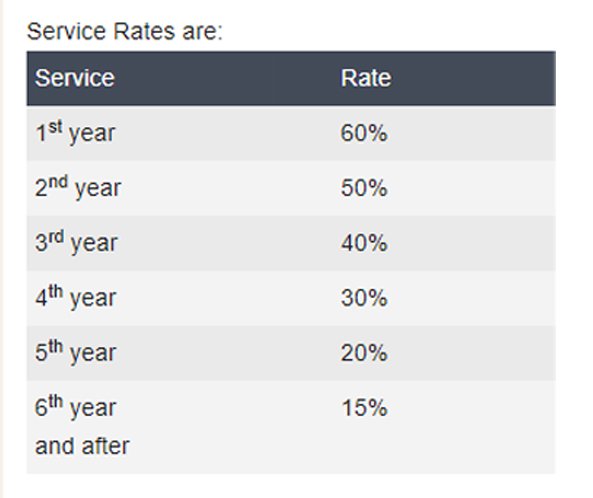

In cities and counties the proportion of labor costs is 75 and 2 respectively. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

Nebraska Property Tax Calculator. Did South Dakota v. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

What Is Nebraska Sales Tax Rate. Hotel Room Rate 10000 Lincoln Hotel Occupation Tax 400 State and Local Sales Tax 754. There is no applicable county tax or special tax.

A 7 percent combined sales tax rate is mandatory for Lincoln Nebraska in 2021. Nebraska Sales Tax Calculator. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

Sales Tax State Local Sales Tax on Food. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling 175. Lincoln NE 68509-4877 Phone.

Nebraska sales tax details. The County sales tax rate is. In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5.

Method to calculate Lincoln sales tax in 2021. Overview of Nebraska Taxes. At 161 Nebraska has the ninth-highest average effective property tax rate in the US.

The Nebraska NE state sales tax rate is currently 55. 800-742-7474 NE and IA. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Sales Tax State Local Sales Tax on Food. Nebraska Capital Gains Tax. Nebraska has a 55 statewide sales tax rate but also has 295.

Ad Standardize Taxability on Sales and Purchase Transactions. If this rate has been updated locally please contact us and we. A Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed.

Wayfair Inc affect Nebraska. One percent one percent one percent. The sales tax rate for Lincoln was updated for the 2020 tax year this is the current sales tax rate we are using in the Lincoln Nebraska Sales Tax Comparison Calculator for 202223.

The state sales tax in Nebraska is 550. The Nebraska sales tax rate is currently. Watch How To Calculate Nebraska Sales Tax Video.

Interactive Tax Map Unlimited Use. The following table shows the sales tax rates by state county and city. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Department of Revenue Current Local Sales and Use Tax Rates. Real property tax on median home. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

You can print a 725 sales tax table hereFor tax rates in other cities see Nebraska sales taxes by city and county. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. There are no changes to local sales and use tax rates that are effective January 1 2022.

A 0 percent local sales tax and a 0 use tax can also be imposed. The typical homeowner in Nebraska can expect to pay 2787 annually towards their property tax bill. In Nebraska what are the sales and use tax rates.

The Nebraska state sales and use tax rate is 55 055. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. The Lincoln sales tax rate is.

One of a suite of free online calculators provided by the team at iCalculator. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Fast Implementation Top Customer Service.

This is the total of state county and city sales tax rates.

Simple Car Finance Calculations Auto Loan Amp Lease Payments

Why Households Need 300 000 To Live A Middle Class Lifestyle

New Mexico Sales Tax Calculator

Why Households Need 300 000 To Live A Middle Class Lifestyle

Louisiana Sales Tax Calculator Reverse Sales Dremployee

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

How To Register For A Sales Tax Permit In Nebraska Taxjar Blog

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Nebraska Income Tax Calculator Smartasset

Nebraska Sales Tax Rates By City County 2022

Montana Sales Tax Rates By City County 2022

Nebraska Sales Tax Small Business Guide Truic

South Carolina Sales Tax On Cars Everything You Need To Know

Turbotax 2018 Tax Software For Filing Past Years Taxes Prior Year Tax Preparation

Nebraska Sales Tax Guide And Calculator 2022 Taxjar